- 9 June, 2023

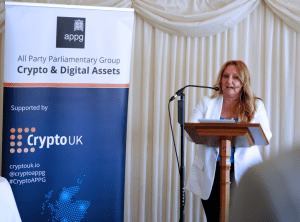

At this week’s launch of the APPG Inquiry in to crypto and digital assets (titled ‘Realising Government’s Vision for the UK to Become a Global Hub for Cryptocurrency & Fintech Innovation’), CryptoUK, the secretariat of the APPG and all those who contributed to the inquiry, convened in Parliament to hear the launch event speech given by the Chair of the APPG, Dr. Lisa Cameron MP.

(This is a transcript of the speech which may differ slightly from delivery)

‘Good afternoon everyone and welcome to Westminster.

I am delighted to see so many of you here today for the launch of the APPG’s first report into the Cryptocurrency and Digital Asset industry.

I would like to first start by thanking each and every one of you for participating in our inquiry and for sharing your views. You have all helped to inform our report and to shape our recommendations to Government.

This has been a significant piece of work over the last ten months, since we first launched our initial inquiry in August last year.

We took the decision to launch our inquiry following the UK Government’s announcement of its landmark vision to make the UK the global hub for cryptocurrency investment.

We wanted to better understand the opportunities that a regulated industry could bring to the UK as well as the challenges and potential barriers for Government in making its vision for the UK a reality.

Our inquiry looked at a number of key areas including:

-

- the potential for the UK to be a global hub for cryptocurrency investment;

- the UK’s approach to regulation of cryptocurrency and the role of UK regulators;

- the potential offered by Central Bank Digital Currencies and a Digital Pound;

- and the risks faced in terms of Consumer Protection and Economic Crime.

Our inquiry invited views from operators, regulators, industry experts and the general public on the need for regulation of the sector.

We also held a number of public evidence sessions in Parliament to hear from experts on the considerations that need to be made in order for the Government to achieve its vision for the sector.

The result is a wide ranging and comprehensive report that sets out the primary issues and considerations for policymakers when developing future regulation for the cryptocurrency and digital asset industry in the UK.

I want to thank all of you for sharing your views and helping us to create this report.

I also would like to say a big thank you to our secretariat CryptoUK for their ongoing support. As the UK’s leading trade body, CryptoUK’s work is vital in helping policymakers better understand the complex world of cryptocurrency and digital assets and to ensure that the voice of the industry is heard.

Hopefully you will all have had a chance to take a look at our report, and we also have copies of the report for each of you here today.

This is not the end of our work on this and I look forward to your views on the findings set out in our report and continued discussion about the need for regulation of the industry.

We have put forward over 50 recommendations in our report which we hope will establish a foundation for further discussion and debate regarding the future of cryptocurrency and digital asset regulation in the UK and to help inform policymakers.

I won’t go through all of those recommendations today, but I did want to share with you some of our overall learnings from our inquiry.

Having heard from all of you throughout our inquiry it’s quite clear that:

-

- Cryptocurrency is here to stay and we need proper and clear regulation in order to protect consumers and to support the growth of the industry;

-

- The growth of cryptocurrency and digital assets does present a number of potential opportunities and the UK is well placed to harness these opportunities but it will require cross governmental strategic planning to realise them.

-

- Equally, without comprehensive regulation, there are also considerable risks particularly in terms of consumer protection, economic crime, and financial stability. We also need clarity over areas including taxation and legal classification of these assets.

-

- And as other countries around the world are moving quickly to develop clear regulatory frameworks for cryptocurrency and digital assets. The UK must move quickly, within the next 12-18 months, to ensure early leadership and not lose out to other countries overseas.

We also identified some potential barriers to the UK realising its vision in our report, for example:

-

- The inquiry heard that at present the process for cryptoasset businesses to enter the UK is too burdensome and lengthy, resulting in many businesses ultimately choosing to invest outside of the UK. We need to ensure that regulators have the resources they need to deliver on their responsibilities.

-

- We need a joined up and coordinated approach across all Government Departments and we have said that Government should consider the appointment of a ‘Crypto Tsar’ who could help coordinate across departments to ensure a consistent approach.

-

- Another area of concerns for many firms is access to basic financial services. The inquiry heard that UK firms often struggle to secure access to UK banking services and we are urging Government to take urgent steps to ensure that there are clear pathways for firms to access fundamental banking facilities.

Central to all of this will be the need for collaboration and engagement. This is important because when we talk about what the future of crypto regulation might look like it’s imperative that we all work together in the same direction to ensure that we get this right. That means Government, central banks, regulators, policymakers and industry all working together with the same goal of developing a regulatory framework that is fit for purpose.

I am delighted with the impact that the APPG has already had in such a short space of time, and less than 18 months since it was first formed here in Westminster it is already being recognised as one of the leading groups in Parliament for MPs and Lords who want to learn more about the industry.

The APPG, and we as policymakers, rely on your sharing your views and expertise, to help inform the debate about the future regulation of the sector, and to ensure that we deliver regulation and policy that works.

So I want to close by thanking you all again for joining us here today, and for your contributions to our inquiry.

We hope you are pleased with the report, and please continue to engage with the APPG as we continue our work in this space.

Thank you.’

Report in Summary:

The report makes a total of 53 recommendations to Government on a number of key areas including the UK’s approach to regulation of cryptocurrency; the role and current approach of UK regulators; the potential offered by Central Bank Digital Currencies – ‘a Digital Pound’; and risks faced in terms of Consumer Protection and Economic Crime.

- The report said that cryptocurrency is here to stay and needs to be regulated to protect consumers; adding that the UK is well placed to harness the opportunities from the growth of the sector but without comprehensive regulation there are considerable risks particularly in terms of consumer protection, economic crime, and financial stability.

- The report said that as other countries around the world are moving quickly to develop clear regulatory frameworks for cryptocurrency and digital assets, the UK must move quickly within the next 12-18 months to ensure early leadership within this sector.

- The report also said that cryptocurrency and digital assets are best regulated within existing and new financial services regulations, which has a track record in mitigating risks to consumers and investors.

- Lisa Cameron MP said “I like people to pay tax when they make gains in the U.K. and that can only be achieved under the financial services regulation rather than gambling” as winnings from gambling are not taxed, whereas gains on investments usually are. She added that financial services regulations offer the best and most robust protections for consumers.

You can download the report here

Download the summary report here

Full inquiry launch press release here